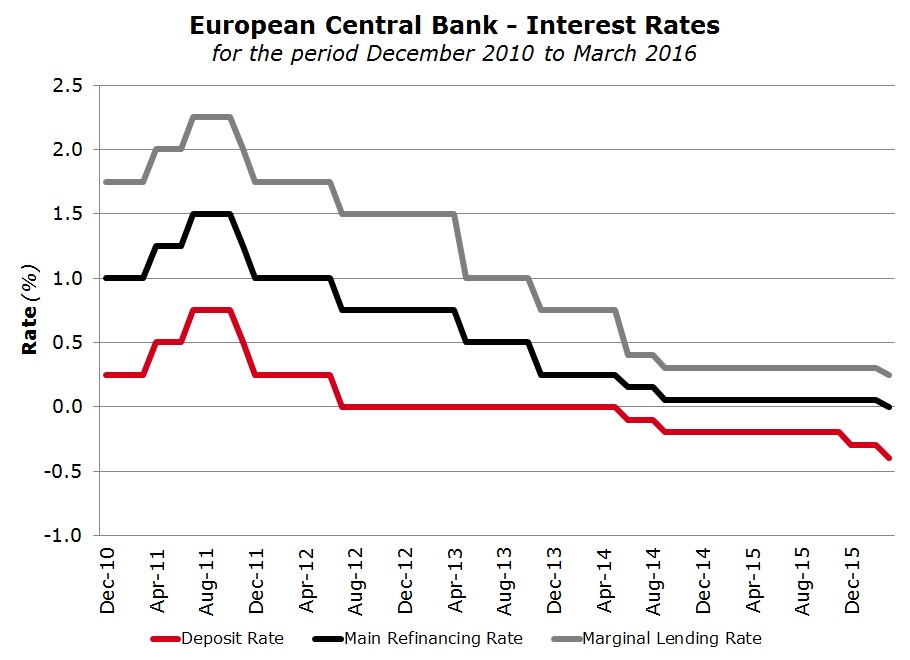

Grande vegas online. In April 2011, the ECB raised interest rates for the first time since 2008 from 1% to 1.25%, with a further increase to 1.50% in July 2011. However, in 2012–2013 the ECB sharply lowered interest rates to encourage economic growth, reaching the historically low 0.25% in November 2013. Jugar slot pharaoh's fortune gratis.

Ecb Deposit Rate

| Date (with effect from) | Deposit facility | Main refinancing operations | Marginal lending facility | ||

|---|---|---|---|---|---|

| Fixed rate tenders Fixed rate | Variable rate tenders Minimum bid rate | ||||

| 2019 | 18 Sep. | −0.50 | 0.00 | - | 0.25 |

| 2016 | 16 Mar. | −0.40 | 0.00 | - | 0.25 |

| 2015 | 9 Dec. | −0.30 | 0.05 | - | 0.30 |

| 2014 | 10 Sep. | −0.20 | 0.05 | - | 0.30 |

| 11 Jun. | −0.10 | 0.15 | - | 0.40 | |

| 2013 | 13 Nov. | 0.00 | 0.25 | - | 0.75 |

| 8 May. | 0.00 | 0.50 | - | 1.00 | |

| 2012 | 11 Jul. | 0.00 | 0.75 | - | 1.50 |

| 2011 | 14 Dec. | 0.25 | 1.00 | - | 1.75 |

| 9 Nov. | 0.50 | 1.25 | - | 2.00 | |

| 13 Jul. | 0.75 | 1.50 | - | 2.25 | |

| 13 Apr. | 0.50 | 1.25 | - | 2.00 | |

| 2009 | 13 May | 0.25 | 1.00 | - | 1.75 |

| 8 Apr. | 0.25 | 1.25 | - | 2.25 | |

| 11 Mar. | 0.50 | 1.50 | - | 2.50 | |

| 21 Jan. | 1.00 | 2.00 | - | 3.00 | |

| 2008 | 10 Dec. | 2.00 | 2.50 | - | 3.00 |

| 12 Nov. | 2.75 | 3.25 | - | 3.75 | |

| 15 Oct.4 | 3.25 | 3.75 | - | 4.25 | |

| 9 Oct.3 | 3.25 | - | - | 4.25 | |

| 8 Oct. | 2.75 | - | - | 4.75 | |

| 9 Jul. | 3.25 | - | 4.25 | 5.25 | |

| 2007 | 13 Jun. | 3.00 | - | 4.00 | 5.00 |

| 14 Mar. | 2.75 | - | 3.75 | 4.75 | |

| 2006 | 13 Dec. | 2.50 | - | 3.50 | 4.50 |

| 11 Oct. | 2.25 | - | 3.25 | 4.25 | |

| 9 Aug. | 2.00 | - | 3.00 | 4.00 | |

| 15 Jun. | 1.75 | - | 2.75 | 3.75 | |

| 8 Mar. | 1.50 | - | 2.50 | 3.50 | |

| 2005 | 6 Dec. | 1.25 | - | 2.25 | 3.25 |

| 2003 | 6 Jun. | 1.00 | - | 2.00 | 3.00 |

| 7 Mar. | 1.50 | - | 2.50 | 3.50 | |

| 2002 | 6 Dec. | 1.75 | - | 2.75 | 3.75 |

| 2001 | 9 Nov. | 2.25 | - | 3.25 | 4.25 |

| 18 Sep. | 2.75 | - | 3.75 | 4.75 | |

| 31 Aug. | 3.25 | - | 4.25 | 5.25 | |

| 11 May | 3.50 | - | 4.50 | 5.50 | |

| 2000 | 6 Oct. | 3.75 | - | 4.75 | 5.75 |

| 1 Sep. | 3.50 | - | 4.50 | 5.50 | |

| 28 Jun.2 | 3.25 | - | 4.25 | 5.25 | |

| 9 Jun. | 3.25 | 4.25 | - | 5.25 | |

| 28 Apr. | 2.75 | 3.75 | - | 4.75 | |

| 17 Mar. | 2.50 | 3.50 | - | 4.50 | |

| 4 Feb. | 2.25 | 3.25 | - | 4.25 | |

| 1999 | 5 Nov. | 2.00 | 3.00 | - | 4.00 |

| 9 Apr. | 1.50 | 2.50 | - | 3.50 | |

| 22 Jan. | 2.00 | 3.00 | - | 4.50 | |

| 4 Jan. 1 | 2.75 | 3.00 | - | 3.25 | |

| 1 Jan. | 2.00 | 3.00 | - | 4.50 | |

| (interest rate levels in percentages per annum) | |||||

Prior to 10 March 2004, changes to the interest rate for main refinancing operations were, as a rule, effective as of the first operation following the date indicated, unless stated otherwise. The change on 18 September 2001 was effective on that same day. From 10 March 2004 onwards, the date refers both to the deposit and marginal lending facilities and to the main refinancing operations (with changes effective from the first main refinancing operation following the Governing Council decision), unless otherwise indicated.

|

Ecb Deposit Rate Graph

| Date (with effect from) | Deposit facility | Main refinancing operations | Marginal lending facility | ||

|---|---|---|---|---|---|

| Fixed rate tenders Fixed rate | Variable rate tenders Minimum bid rate | ||||

| 2019 | 18 Sep. | −0.50 | 0.00 | - | 0.25 |

| 2016 | 16 Mar. | −0.40 | 0.00 | - | 0.25 |

| 2015 | 9 Dec. | −0.30 | 0.05 | - | 0.30 |

| 2014 | 10 Sep. | −0.20 | 0.05 | - | 0.30 |

| 11 Jun. | −0.10 | 0.15 | - | 0.40 | |

| 2013 | 13 Nov. | 0.00 | 0.25 | - | 0.75 |

| 8 May. | 0.00 | 0.50 | - | 1.00 | |

| 2012 | 11 Jul. | 0.00 | 0.75 | - | 1.50 |

| 2011 | 14 Dec. | 0.25 | 1.00 | - | 1.75 |

| 9 Nov. | 0.50 | 1.25 | - | 2.00 | |

| 13 Jul. | 0.75 | 1.50 | - | 2.25 | |

| 13 Apr. | 0.50 | 1.25 | - | 2.00 | |

| 2009 | 13 May | 0.25 | 1.00 | - | 1.75 |

| 8 Apr. | 0.25 | 1.25 | - | 2.25 | |

| 11 Mar. | 0.50 | 1.50 | - | 2.50 | |

| 21 Jan. | 1.00 | 2.00 | - | 3.00 | |

| 2008 | 10 Dec. | 2.00 | 2.50 | - | 3.00 |

| 12 Nov. | 2.75 | 3.25 | - | 3.75 | |

| 15 Oct.4 | 3.25 | 3.75 | - | 4.25 | |

| 9 Oct.3 | 3.25 | - | - | 4.25 | |

| 8 Oct. | 2.75 | - | - | 4.75 | |

| 9 Jul. | 3.25 | - | 4.25 | 5.25 | |

| 2007 | 13 Jun. | 3.00 | - | 4.00 | 5.00 |

| 14 Mar. | 2.75 | - | 3.75 | 4.75 | |

| 2006 | 13 Dec. | 2.50 | - | 3.50 | 4.50 |

| 11 Oct. | 2.25 | - | 3.25 | 4.25 | |

| 9 Aug. | 2.00 | - | 3.00 | 4.00 | |

| 15 Jun. | 1.75 | - | 2.75 | 3.75 | |

| 8 Mar. | 1.50 | - | 2.50 | 3.50 | |

| 2005 | 6 Dec. | 1.25 | - | 2.25 | 3.25 |

| 2003 | 6 Jun. | 1.00 | - | 2.00 | 3.00 |

| 7 Mar. | 1.50 | - | 2.50 | 3.50 | |

| 2002 | 6 Dec. | 1.75 | - | 2.75 | 3.75 |

| 2001 | 9 Nov. | 2.25 | - | 3.25 | 4.25 |

| 18 Sep. | 2.75 | - | 3.75 | 4.75 | |

| 31 Aug. | 3.25 | - | 4.25 | 5.25 | |

| 11 May | 3.50 | - | 4.50 | 5.50 | |

| 2000 | 6 Oct. | 3.75 | - | 4.75 | 5.75 |

| 1 Sep. | 3.50 | - | 4.50 | 5.50 | |

| 28 Jun.2 | 3.25 | - | 4.25 | 5.25 | |

| 9 Jun. | 3.25 | 4.25 | - | 5.25 | |

| 28 Apr. | 2.75 | 3.75 | - | 4.75 | |

| 17 Mar. | 2.50 | 3.50 | - | 4.50 | |

| 4 Feb. | 2.25 | 3.25 | - | 4.25 | |

| 1999 | 5 Nov. | 2.00 | 3.00 | - | 4.00 |

| 9 Apr. | 1.50 | 2.50 | - | 3.50 | |

| 22 Jan. | 2.00 | 3.00 | - | 4.50 | |

| 4 Jan. 1 | 2.75 | 3.00 | - | 3.25 | |

| 1 Jan. | 2.00 | 3.00 | - | 4.50 | |

| (interest rate levels in percentages per annum) | |||||

Prior to 10 March 2004, changes to the interest rate for main refinancing operations were, as a rule, effective as of the first operation following the date indicated, unless stated otherwise. The change on 18 September 2001 was effective on that same day. From 10 March 2004 onwards, the date refers both to the deposit and marginal lending facilities and to the main refinancing operations (with changes effective from the first main refinancing operation following the Governing Council decision), unless otherwise indicated.

|

Ecb Deposit Rate Graph

Ecb Overnight Deposit Rate

- The ECB left its key deposit facility rate unchanged at -0.5% on January 21st 2021 as expected. Deposit Interest Rate in the Euro Area averaged 1.27 percent from 1999 until 2021, reaching an all time high of 3.75 percent in October of 2000 and a record low of -0.50 percent in September of 2019. This page provides - Euro Area Deposit Interest Rate- actual values, historical data, forecast.

- The euro foreign exchange reference rates (also known as the ECB reference rates) are published by the ECB at around 16:00 CET. Reference rates for all the official currencies of non-euro area Member States of the European Union and world currencies with the most liquid active spot FX markets are set and published. The ECB aims to ensure that the exchange rates published reflect the market.